Bitcoin’s Coinbase Premium Hits customer interest within the United States hit a 39-day high following the US Federal Reserve in addition confirming that interest rates were because of fall, in keeping with latest records.

“Bitcoin call for within the US spiked these days as the Fed signaled the cycle of lower hobby prices will start,” CryptoQuant Julio Moreno wrote in an Aug. 24 X publish.

Read More: DBS Bank Pilots Blockchain

Bitcoin Price Analysis

Bitcoin rate opened trading simply under $60,000 on August 19, consolidating inside a narrow 4% variety over the weekend. On-chain charts reveal that whale traders on Coinbase were mounting buying strain in view that August five. Is BTC at the verge of a $65k breakout?

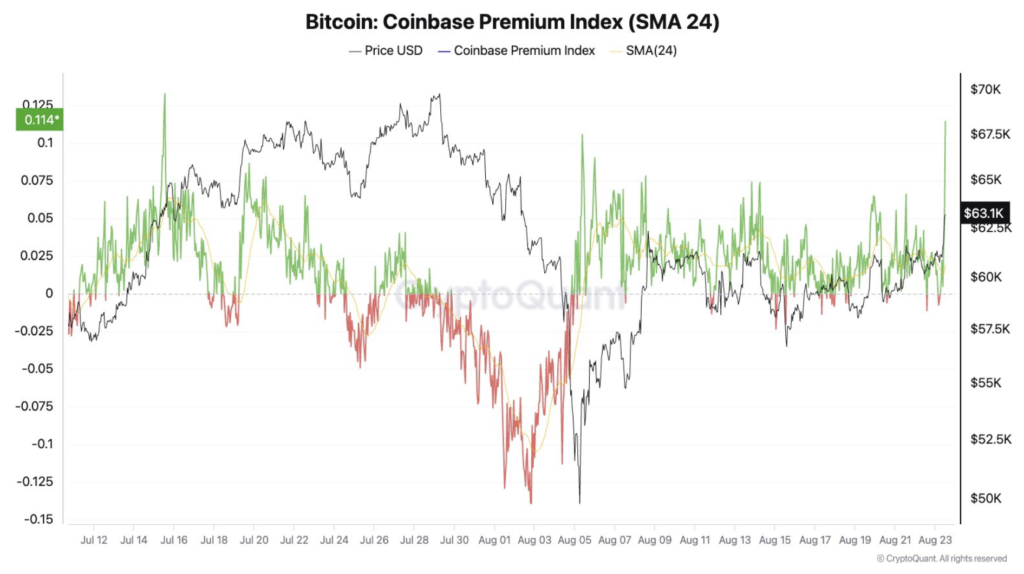

Moreno’s declare turned into primarily based on the Coinbase Premium Index, which measures the space among Bitcoin’s

BTC $63,917

rate on Coinbase Pro and Binance and used as a hallmark of US investor call for in comparison to the rest of the sector.The indicator hit its maximum factor for the reason that July 15, achieving 0.0114.

While fine readings suggest buying stress, terrible readings can signal a promote-off is occurring. Just before “Crypto Black Monday” on Aug. 5, while Bitcoin’s fee fell underneath $50,000, the Coinbase Premium dropped beneath -0.10.

Coinbase is once more buying and selling Bitcoin (BTC) at a top class, elevating the disparity with different markets to a 3-month excessive. The metric is visible as a signal of strong demand from retail consumers. But Coinbase is also the dealer of maximum of the Bitcoin ETF motors, after they need to replenish their reserves.

The Coinbase premium rose, while BTC also extended the share of USD trading to 18% of its total volumes. At the equal time, the proportion of USDT has fallen as little as forty eight%, down from a ordinary degree above fifty five%.

The boom in call for came after Fed Chair Jerome Powell assured the general public that interest price cuts were possibly, but he didn’t specify whilst.

“The time has come for coverage to modify,” he said all through a speech on the annual Jackson Hole symposium.

At the time of book, Bitcoin is buying and selling at $sixty three,978, up 5.Forty six% seeing that Aug. 22, consistent with CoinMarketCap information.

Bulls Chipping Away at $ 60k Resistance

Over the beyond weeks, Bitcoin rate has experienced excessive volatility because the crypto market keeps to flash mixed alerts.

On the upside, Ripple’s perceived victory in its lengthy-running case towards the SEC, along a dovish CPI file, has notably improved crypto marketplace sentiment.

Meanwhile, market worry, uncertainty, and doubt (FUD) emerged asU.S. Authorities moved over $six hundred million worth of BTC, coupled with latest Mt Gox payouts.

Bitcoin’s fee spiked to simply shy of the $sixty five,000 mark, achieving $sixty four,769 — a stage it hadn’t hit on the grounds that Aug. 2.

Cointelegraph recently reported that Powell’s occasion, which markets had keenly watched for coverage easing cues, saw a dovish Powell bring in an “appropriate dialing lower back of policy restraint” even as not giving a concrete timeline for the cuts to begin.

The top rate is a volatile indicator that may shift inside hours, but the trend has remained feasible inside the past few weeks. In the past, BTC additionally carried a top class in Korean won trading, but this time, Upbit prices are barely decrease.

Bitcoin’s Coinbase Premium Hits

The Coinbase premium additionally moved up higher because the start of July, displaying a shift in buying behaviors, whilst BTC was nonetheless correcting at the start of the month. Social media attitudes as measured by means of Santiment shows FOMO posts multiplied over the weekend, placing the stage for the brand new week’s charge rally. Bullish sentiment elevated by means of eight.7% over the weekend, to 48% positive messages amplified via social media.

Without a clear dominant social sentiment subject matter, BTC charge has struggled to make the subsequent leg-up in its recovery section from the August 5 market crash.

Just hours earlier than the Fed’s statement and Bitcoin’s charge surge, Bitcoin was soaring across the $60,000 mark, with worries approximately capacity promoting strain from miners because of the price of mining Bitcoin remaining at $seventy two,224.

Crypto analyst Will Clemente stated that “there’s still 7 days left within the month, but there may be no denying that the marketplace has seen sub $60k BTC as fee for 6 months now,” in an Aug 23 publish.

Whale Traders Enter 14-Day Buying Streak on Coinbase

Whale investors are acknowledged for his or her strategic moves, and their sports can significantly have an impact on BTC fee action in the week ahead.

The Coinbase Premium Index, a metric that compares BTC call for between Binance, regarded to be ruled through retail buyers, and Coinbase, regarded to be dominated by whale investors and corporates, tracks actual-time rate imbalances between each exchanges, presenting clean insights into whales’ contemporary trading sentiment.

Bitfinex nevertheless has BTC at a top class, however spot USD marketplace leads the rally

The best exception to the USD premium is Bitfinex, one of the intently watched BTC exchanges. On Bitfinex, the leading coin traded at a top class towards USDT, with a charge of $65,790.00. It turned into Bitfinex that marked the beginning of the modern expansion cycle, when analysts referred to renewed buying behavior from whales.

The spot marketplace is also at a top rate, while BTC awaits the renewal of open hobby. In the past day, open hobby on futures recovered to above $18B, with Binance yet again the chief at $7.7B.

The modern day rally above $sixty five,000 focused brief positions at that degree, for now lowering derivatives open hobby. The current rally remains led by means of spot positions, with predictions of $sixty eight,000 coming subsequent.

BTC additionally revealed strong spot premiums all through preceding bullish durations, at some point of the climb to an all-time excessive in Q2.

BTC faces a mixture of irrational hype and trading

BTC price movement is displaying a few signs and symptoms of irrational buying, in addition to recent news of acknowledged whales like Mr. 100 adding more coins. But the irrational hype may be hampered by using buyers’ choices.

The recent shopping for remains now not setting up a protracted-time period structure, or adhering to a price version. Trader open interest may also continue to sway the marketplace.

The BTC spot marketplace is likewise eyeing the scenarios of coins coming from the Mt. Gox payout pockets. Kraken now holds 47K BTC, ready to begin paying out lenders in kind. It is still unsure if the lenders could decide to sell for income after extra than a decade of retaining, or keep storing their coins.