Bitcoin Mining Firms Artificial Intelligence Ai HPC Revenue Boost to earn a further $13.Nine billion each year by 2027 if they begin presenting power to the growing synthetic intelligence (AI) and excessive-overall performance computing (HPC) sectors.

This insight comes from an August sixteen file by funding firm VanEck, which sees this shift as a way for miners to enhance their income amid demanding situations within the Bitcoin market.

Read More: Bitcoin Transaction Tracker

“AI organizations want electricity, and Bitcoin miners have it,” the report states. VanEck believes that Bitcoin miners, who face economic challenges because of risky Bitcoin prices and rising running charges, should improve their balance with the aid of redirecting a element of their electricity assets closer to AI and HPC wishes.

Bitcoin miners have the possibility to doubtlessly generate round $13.9 billion in extra yearly revenue if they in part transition to presenting strength to the artificial intelligence and high-overall performance computing (HPC) sector through 2027, in keeping with investment organization VanEck.

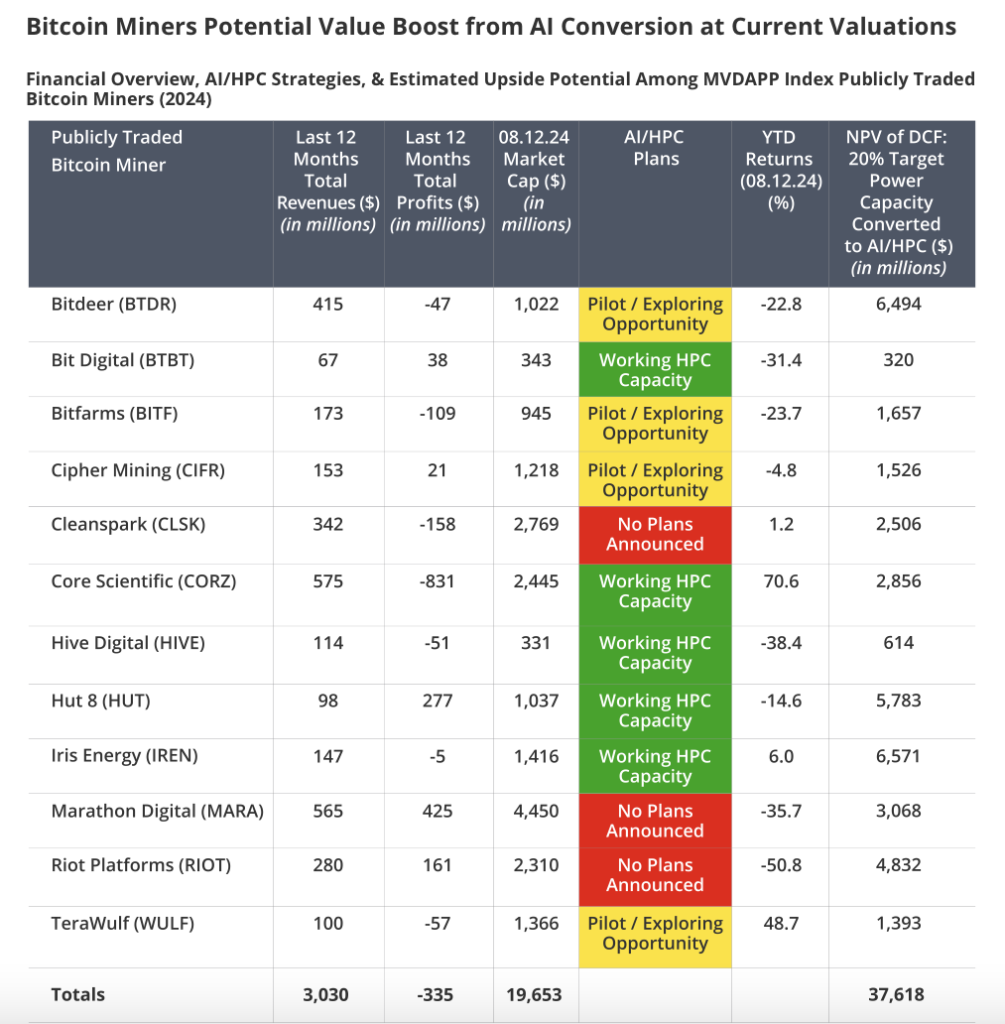

The report shows that if publicly traded mining corporations allocated 20% in their energy capacity to AI and HPC by using 2027, they may together upload round $thirteen.9 billion in annual sales over the subsequent 13 years.

Many Bitcoin mining businesses are currently having financial troubles because of high debt, overpaying executives, and poor stability sheets due to the April halving, which reduce block rewards in half of.

VanEck argues that working with AI and HPC groups should help address these troubles, as such corporations typically have the finances needed to cowl power costs and infrastructure.However, a few miners are already shifting on this path. For instance, Core Scientific, certainly one of the most important Bitcoin miners through hash charge, lately signed a 12-12 months deal with AI agency CoreWeave. This agreement is predicted to herald over $3.5 billion by means of providing two hundred MW of infrastructure.

Bitcoin miners might also significantly boost their sales with the aid of transferring a number of their electricity capability to artificial intelligence and excessive-overall performance computing (HPC), in line with investment company VanEck. The corporation indicates that by using 2027, miners ought to generate a further $thirteen.9 billion annually in the event that they allocate 20% in their strength closer to those sectors.

The VanEck report posted on August 16 discovered that Bitcoin miners are struggling due to the fact their working fees lack operational balance and Bitcoin expenses’ balance. AI and HPC could help miners stabilize their financial conditions through diversifying operations. ”AI groups require energy, and Bitcoin miners have strength,” the file said.

AI groups want electricity, and Bitcoin miners have it,” VanEck said in an Aug. Sixteen document.

“Bitcoin miners commonly have bad stability sheets, both due to too much debt, an excessive amount of percentage issuance, too much executive repayment, or some aggregate of all three,” VanEck claimed.’

Kerrisdale Slams Bitcoin Miners, VanEck Sees Opportunity in AI Partnerships

The inspiration comes while the Bitcoin mining enterprise is facing complaint due to its impact on electricity intake. Recently, the investment firm Kerrisdale Capital said unfavourable things about Bitcoin miners; they noted these companies as an ‘industry of snake oil salesmen,’ They have talked about that the commercial enterprise fashions of those corporations at the contemporary time are not sustainable. For example, Sahm Adrangi, the Chief Investment Officer of Kerrisdale Capital, indicated that most of the Bitcoin mining organizations presented shares in an try to generate price range to aid their operations. Yet, they do no longer supply the required returns.

VanEck estimates that if publicly traded Bitcoin mining companies shifted 20% in their power potential to AI and HPC via 2027, “general additional every year income may want to exceed a median of $13.Nine billion in keeping with yr over thirteen years.”

However, VanEck thinks an endorsement percent with AI players might be disruptive. AI companies are usually willing to fund steeply-priced infrastructure charges, giving Bitcoin miners the monetary protection they require. One of the important thing players inside the Bitcoin mining area, Core Scientific, inked a deal with the AI hyperscaler CoreWeave to be able to closing for 12 years. This unique deal is anticipated to attain more than $three.Five billion in sales hooked up thru offering 200MW of systems.

Hive Digital Technologies, a Canadian mining organization, is also building greater facilities to offer HPC offerings to special industries, together with gaming, AI, and snap shots.

Lastly, it is able to be said that as strength consumption in AI and HPC will increase in the future, miners may be capable of supply brought cost by using the usage of that energy to help their operations, hence improving their financial scenario. With a part of strength assets transferred, they cannot most effective avoid excessive risks associated with Bitcoin fluctuation however additionally enjoy the AI and HPC industries.

The feedback follow latest claims via investment organization Kerrisdale Capital calling the Bitcoin mining industry an “enterprise of snake oil salesmen.” The company claimed that, in its present day form, Bitcoin mining corporations are not feasible business models and, as a result, intentionally dilute.

“They trouble shares, they take the ones stocks to make investments inside the business. But there are no returns,” Sahm Adrangi, chief funding officer of Kerrisdale Capital, recently instructed Cointelegraph.

Meanwhile, VanEck mentioned that the gain of Bitcoin

BTC

miners moving into such contracts is that AI agencies are commonly willing to offer the financial resources wanted for capital expenditure.Core Scientific, the fourth largest Bitcoin miner by hashrate, recently landed a 12-12 months contract with AI hyperscaler CoreWeave. This deal is predicted to generate over $3.Five billion in sales via presenting 200 megawatts of infrastructure.

Meanwhile, Canadian miner Hive Digital Technologies has persisted increasing its facilities to provide HPC services to groups inside the gaming, artificial intelligence, and images rendering industries, according to its fourth area 2023 record.

VanEck’s document comes amid a difficult yr for Bitcoin miners, following the April Bitcoin halving, which cut mining rewards from 6.25 BTC to three.A hundred twenty five BTC for adding a block to the blockchain.

On Aug. 2, Cointelegraph said that United States-listed Bitcoin miner Marathon Digital suggested revenue of $a hundred forty five.1 million inside the second quarter, roughly nine% decrease than the $157.Nine million that analysts had anticipated.

On April 8, just prior to the Bitcoin halving, CryptoQuant CEO Ki Young Ju estimated the cost of mining using Antminer S19 XPs might upward thrust from $40,000 to $80,000 after the Bitcoin halving in mid-April. At the time of booklet, Bitcoin is trading at $59,550, in accordance to CoinMarketCap data.